Update: Unfortunately, Bitspark ceased operations in March 2020, due to an internal restructuing and a decision taken by the board.

I was introduced to Bitspark after listening to Charlie Shrem’s podcast episode on Untold Stories with Maxine Ryan, Co-Founder and COO of Bitspark. Bitspark, in a nutshell, provides a truly easy way for everybody (especially the unbanked) to on-ramp from Fiat to Cryptocurrency. The primary use-case, as I see it, is an easy way for peer to peer payments (be it fiat or cryptocurrency) to be done, especially in rural developing markets where many people are unbanked or underserved with traditional banking facilities.

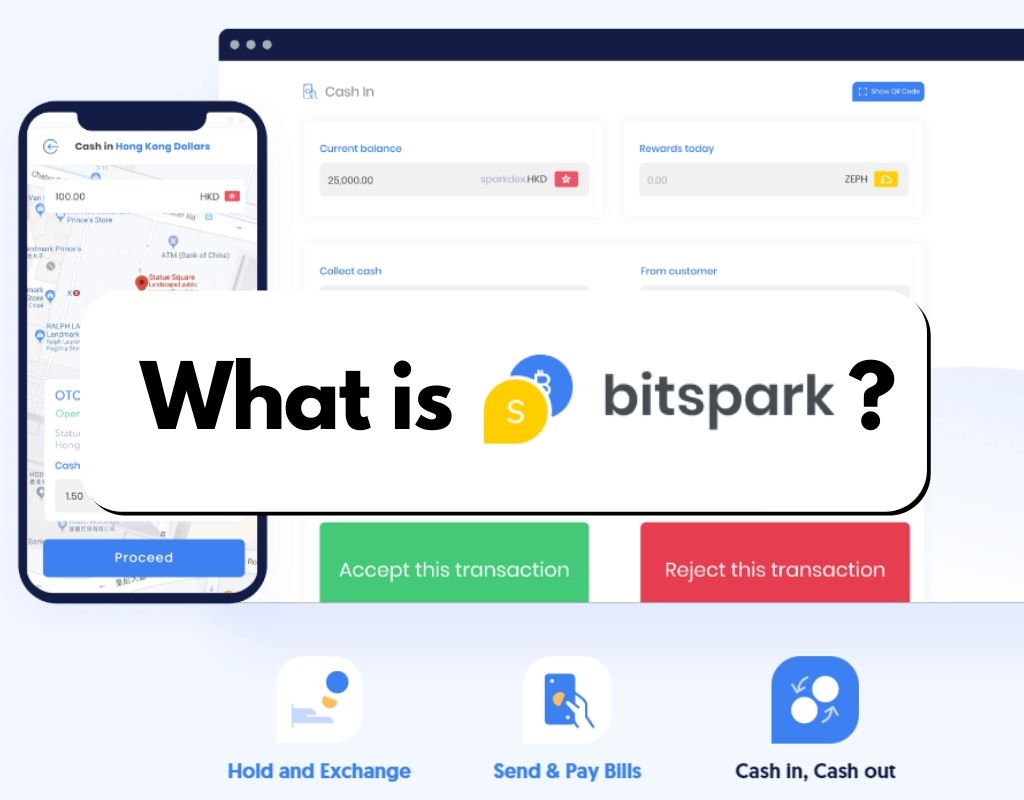

What is Bitspark?

Bitspark is a cryptocurrency platform that allows anyone, even the unbanked, to

- convert cash into crypto

- send and pay bills P2P

- cash in and cash out

Bitspark operates out of its Hong Kong HQ, and is currently serving developing Asian markets such as Philippines, Indonesia, Malaysia and Vietnam.

Bitspark claims to have over 500,000 cash points as of end 2019.

Bitspark also supports a slew of cryptocurrencies that you can buy or sell within the app, such as Bitcoin (BTC), Ethereum (ETH), Zeph (ZEPH, their own token used for rewarding referrals and usage), and Bitshares (BTS). Ass a cash in cash out platform, they also support a list of stablecoins:

- Sparkdex.HKD, a token pegged to the Hong Kong Dollar – HKD

- Sparkdex.EUR, a token pegged to the Euro – EUR

- Sparkdex.GBP, a token pegged to the British Pound – GBP

- bitUSD, a token pegged to the United States Dollar – USD

- Sparkdex.AUD, a token pegged to the Australian Dollar – AUD

- bitCNY, a token pegged to the Chinese Yen – CNY

- Sparkdex.SGD, a token pegged to the Singapore Dollar – SGD

- stable.PHP, a token pegged to the Philippine Peso – PHP

What makes Bitspark unique?

In my opinion, it’s the cash-in-cash-out functionality that effectively helps bitspark stand out from the sea of cryptocurrency platforms that aim to onboard folks into crypto.

For today’s use-case, it is not enough for us to be able to buy and hold cryptocurrency. To buy crpyto, most of us will also have to use platforms such as coinbase, which requires stringent KYC, as well as linking to a bank account, or purchasing crypto using credit cards (which means you need to be a bank customer).

Bitspark, while not the first platform or service to help the unbanked, seems to be the first to be able to truly scale, in serving the unbanked. This is due to their cash point concept.

What is a Bitspark cash point?

A bitspark cash point, can be a person or place, where one can cash in and cash out of their assets held in bitspark. Think of Bitspark cash points as a vast network of ATMs and money changers, powered by bitspark users.

They can set up cash points in a mall, a retail shop, or even just as a roving person, where you can meet up in person to either pass your cash for crypto, or “withdraw” cash from. A process that totally bypasses the banking system, instead using peer to peer and building up a global network of cash points.

No infrastructure, no hardware, no rental of space. Just people, powered by their mobile devices. Nice.

You can find out more about joining the Bitspark Cash Point Network from Maxine herself via the YouTube video below.

The Unbanked World

According to this worldbank.org article, as of 2019, 1.7 billion adults in the world remain unbanked. BUT, two-thirds of them own mobile devices that can help them gain access to financial services.

This is probably where Bitspark sees a huge opportunity. These people may not necessarily want to be brought into the traditional banking world, but it would definitely help them to be able to move money or make payment or receive payment in a more seamless fashion across borders.

Philippines, the world’s fourth largest remittance destination (at $30bn a year) will definitely be an interesting battleground to watch as these platforms wage war with traditional remittance players.

Creating your Bitspark Account

Intrigued, I wanted to create a bitspark account and see for myself how easy or difficult that process was, in addition I also wanted to find out more about being a cash point, and the process of being one.

Creating an initial account was easy. If you don’t want to be a cash point, and will only transact in small amounts (less than $1,000), you don’t have to be a verified user. In that case, all you need is to provide an email and a password, and voila, you have created an account.

To transact in larger volumes, or to become a cash point, you’ll first need to be verified, which means you’ll need to upload a photo ID, as well as fund your bitspark account.

Once you’re verified, you can then log in, and click on “Cash Point”. This will bring you to a screen, where you can specify where your cash point will be located, and the operating hours.

One thing I’d like to know, and will probably reach out to Bitspark for clarification is how that would be managed, if I were a roving cash point with no one physical location. (ie, I can be a cash point wherever my current location may be, and that will change over the course of the day)

In any case, I created my account, verified myself, funded the account and applied and was accepted to be a cash point, all within the space of 2 days. Efficient!

If you’re a crypto enthusiast and is also curious to try out new platforms…

Tackling the Remittance Industry

I have (actually in the process of hiring a new one) a domestic helper from the Philippines, and remittance is a big thing for the country. My domestic helper, when she had a payday, would usually go to the remittance centre, and queue for sometimes between 30 minutes to an hour, and pay exorbitant fees (I believe it was about 5%) to be able to send money back home.

With platforms like Remitly, TransferWise and Bitspark disrupting the traditional remittance players, we can expect a win for consumers, with low fees and convenience (both on the sending and receiving end) winning out.

I will definitely be telling my new domestic helper about these better and faster technology to safely send her hard earned money back home, and test out Bitspark in the wild.

For those of you who don’t have a use-case for cashing in and out, but would prefer to be able to spend their cryptocurrency easily (such as with a debit card), and would like free Netflix and Spotify, check out my review on the MCO VISA card.